LianBio, a biotechnology firm devoted to bringing novel medicines to patients in China and other key Asian countries, announced today the start of its proposed initial public offering (IPO) of its American depositary shares (“ADSs”). The Securities and Exchange Commission (“SEC”) has approved LianBio’s registration statement on Form S-1 to sell 20,312,500 ADSs to the general public. LianBio also proposes to provide the underwriters a 30-day option to acquire up to 3,046,875 more ADSs. The price per share for the first public offering is projected to range between $15.00 and $17.00. LianBio has applied to trade under the ticker symbol “LIAN” on the Nasdaq Global Market. In this post, we will tell you about LianBio IPO Price Prediction.

What is LianBio Related To

The Securities and Exchange Commission (SEC) has received a registration statement pertaining to the planned sale of these securities, but it has not yet become effective. Prior to the effective date of the registration statement, these securities may not be sold or offers to buy accepted. This press release does not constitute an offer to sell or a solicitation of an offer to buy, and no sale of these securities will take place in any state or jurisdiction where such an offer, solicitation, or sale would be illegal prior to registration or qualification under the securities laws of that state or jurisdiction.

Also Read: BITO ETF PRICE PREDICTION

LianBio IPO Price Prediction

You should know that Lian Bio is a biotech industry that is operating overseas. It has its production companies in USA and China. The LianBio is planning to raise more than 300 million dollars. To do that the company will be offering 20.3 million shares. However, the price of shares can vary from $15 to $17. The firm could fully dilute its 1.8 billion dollar market value. You should also know that it has been only two years since the launch of the company and its already going public.

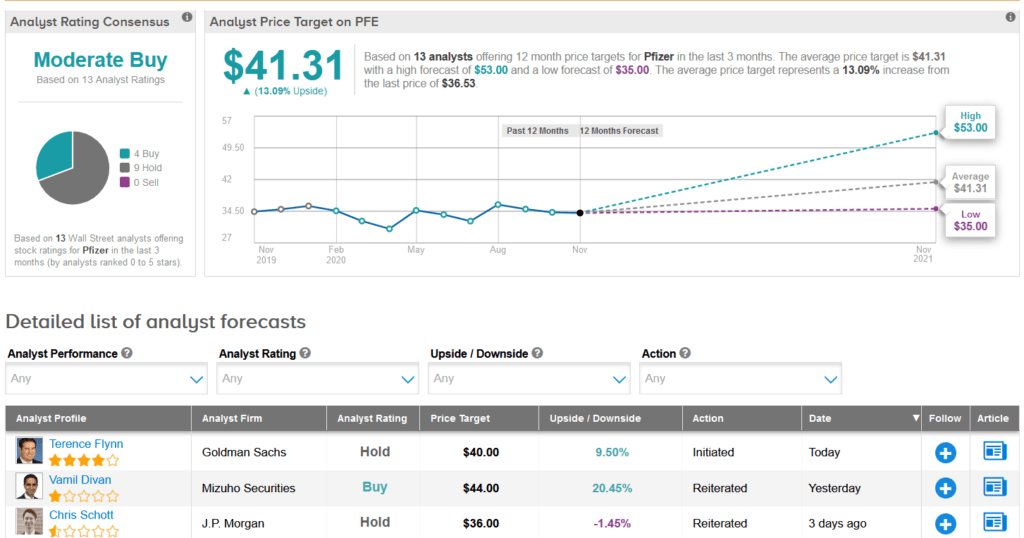

Lets talk about some other crucial details after talking about LianBio IPO Price Prediction. Under the symbol “LIAN,” the firm has sought to list on Nasdaq. The acquisition is being underwritten by Goldman Sachs, Jefferies, BofA Securities, and Raymond James. The funds will be utilised for clinical research and development, as well as general company reasons. “We are a worldwide, science-driven biopharmaceutical business devoted to discovering and commercialising new medicines for patients with unmet medical needs,” the firm claims in its registration documents. “Our first emphasis is on in-licensing assets for Greater China and other Asian markets.” The transaction comes as the Renaissance IPO ETF IPO, -0.88 percent has gained 6% this year, while the S&P 500 SPX, +0.02 percent has risen 20%.

Stay tuned with the global coverage for more updates.